September 22, 2025 - Disseminated On Behalf Of Foremost Clean Energy

Let's dive into Foremost Clean Energy (NASDAQ: FMST).

This stock has been on a run, demonstrating incredible volatility and capturing significant investor attention. After trading around $0.69 in mid-April 2025, FMST staged a dramatic rally, skyrocketing to a high of $5.73 by early June—a gain of over 730% in less than two months.

The stock has since undergone a consolidation phase, stabilizing around the $3.00 level.

This represents a pullback from its peak but still marks an impressive +340% increase from its April lows. This consolidation near current levels is often seen as a potential strengthening phase before the next possible move.

This significant price movement, coupled with a major increase in trading volume over the last several months, underscores growing investor interest in FMST. The momentum aligns perfectly with a global shift in focus toward nuclear power and domestic uranium supply, positioning Foremost as a key player in the clean energy transition.

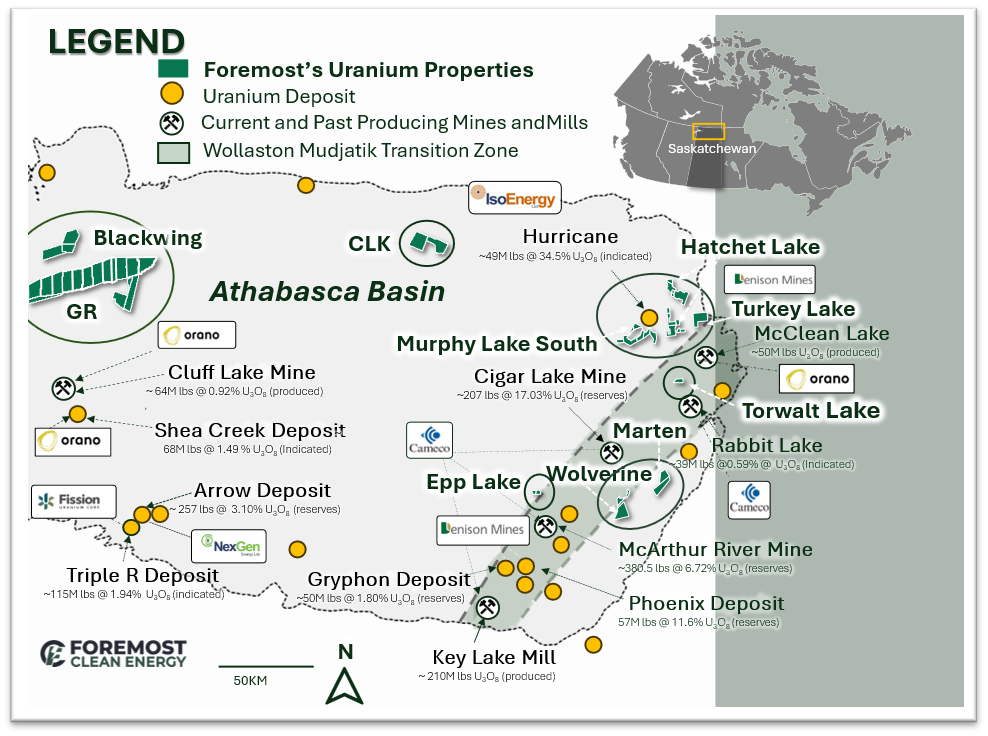

Foremost Clean Energy (NASDAQ: FMST) is a uranium exploration company that delivers a powerful mix of insider backing, tier-one assets, and leverage. Foremost holds 10 properties in the Athabasca Basin (“Saudi Arabia of Uranium”), known to host the highest-grade uranium earth.

The entire uranium sector is absolutely ripping.

From majors like CCJ to UEC to juniors across the board—everything is up double digits. This isn’t retail FOMO: This is institutional momentum hitting a nuclear supply squeeze that’s been building for years.

Backed by Denison Mines, a $2.5B sector leader and uranium producer, Denison is not only their largest shareholder but provides direct access to capital and expertise. This partnership offers a potential fast-track to production, bypassing years of delays just as the uranium supply crunch intensifies.

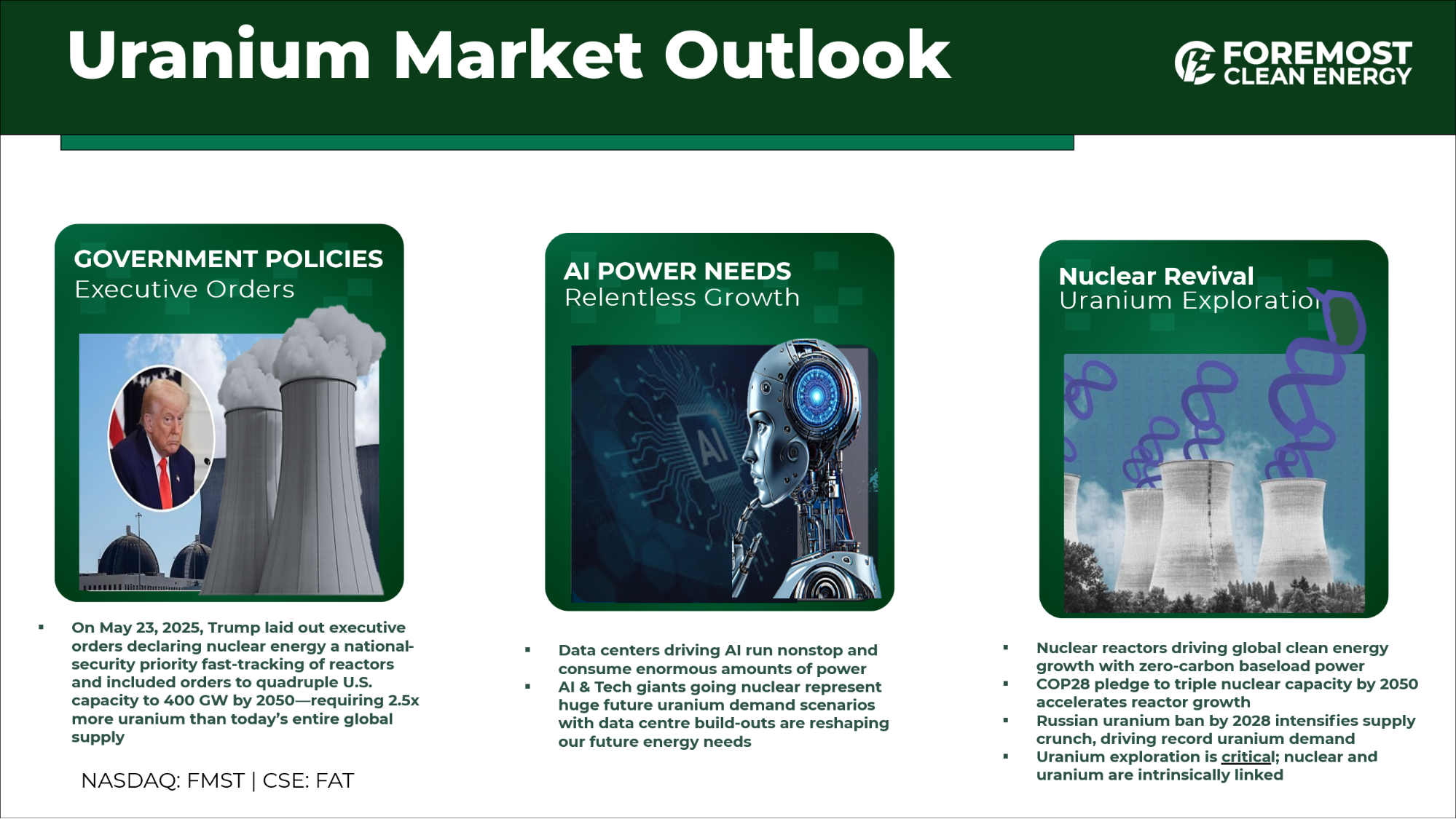

Energy Secretary Chris Wright just announced “We are moving to end the use of Russian enriched uranium. We expect rapid growth in U.S. uranium consumption and urgently need to expand domestic uranium and enrichment capacity.”

Nvidia CEO Jensen Huang recently stated, "AI factories will be the biggest consumers of electricity in the future."

Mercuria, a $15B commodities giant, just launched a physical uranium trading desk, hiring away a top Goldman Sachs uranium trader. Citi and Natixis are building out uranium desks too. They see what’s coming: Uranium demand is set to double by 2040. When the biggest traders on the planet enter the market, you pay attention.

Tech giants are scrambling to find a source for energy and demand for nuclear energy is driven in no small part by the rise of energy-intensive technologies such as crypto mining, AI, and data centers.

Every data center consumes as much energy as a small city. Nuclear is the only scalable, 24/7 clean power source fueled by uranium. Tech giants are locking up nuclear power contracts. The uranium structural deficit is here.

This convergence of technology and policy is creating a perfect storm: President Trump’s executive orders are accelerating reactor approvals, and FMST, the perfect AI adjacency stock, is positioning itself to potentially be one of the solution for the future uranium supply needed to keep America’s tech boom running.

Foremost has secured the option to earn up to a 70% interest in 10 highly prospective uranium properties spanning more than 330,000 acres in the Athabasca Basin, one of the world’s most prolific uranium regions. This agreement with Denison Mines not only makes Denison Foremost’s largest shareholder but also brings direct access to their unparalleled technical expertise, historical drilling data, and cutting-edge ISR (in-situ recovery) mining technology.

With Denison targeting Canada’s first ISR mine by 2028, Foremost is uniquely positioned to bypass traditional development delays and accelerate toward production, an advantage that most of the 60+ other Basin explorers simply cannot match.

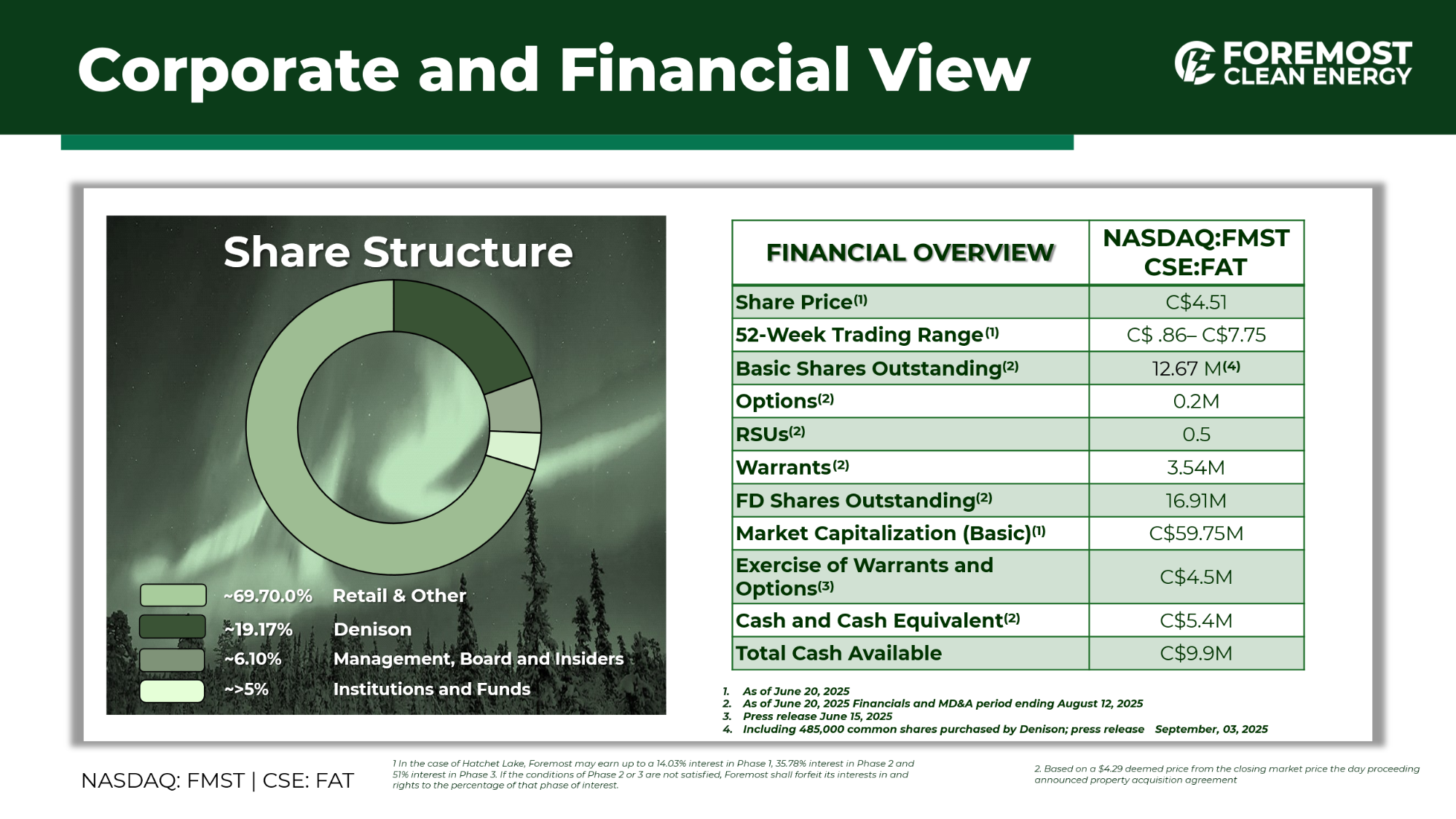

Earlier this month, Denison gave the company a $1M boost and strengthened its treasury by over $1 million through share issuance to increase its ownership to ~19% of the company.

Drill programs are already lined up for 2025, including campaigns at Murphy Lake South. These projects are strategically located near proven uranium corridors, such as the LaRoque Conductive Corridor, host to IsoEnergy’s Hurricane Deposit, one of the highest-grade uranium resources in the world.

Foremosts Properties Surrounded by Mines and Mills

Foremost completed a 2,000 metre drill program at Hatchet Lake Uranium Property recently. Initial drilling already intercepted uranium mineralization and a new discovery (assays pending). For a first drill program to hit mineralization? That’s targeting competence. It also has confirmed that it intersected anomalous radioactivity in 6 out of 10 drill holes—a exceptionally strong early indicator for a first-time drill program.

Foremost’s 10-property portfolio is fully funded with a $6.5 million exploration budget, one of the largest among NASDAQ-listed Athabasca listed explorers, and they are targeting drill-ready projects permitted and positioned along high-impact trends like the Wollaston-Mudjatik Transition Zone, which is home to every producing mine and mill in the Athabasca Basin.

Unlike most juniors focused on single targets, Foremost is diversified across 10 separate properties, each with multiple drill-ready zones and already has proven uranium mineralization across multiple properties. This dramatically increases the odds of a major discovery while spreading exploration risk. It also enables Foremost to launch multiple exploration campaigns simultaneously—something very few peers can do.

FMST also offers bonus asset exposure – over 43,276-acre “Lithium Lane” portfolio in Manitoba that offers exposure to battery metals at no extra cost to uranium-focused investors.

With a drill program planned this fall with goldand lithium co-production potential at its Jean Lake (3.28 oz/t gold hits) lithium/gold property, this asset offers bonus optionality at zero additional cost.

President Trump declared nuclear energy a national security priority with his May 2025 executive orders which include banning Russian uranium imports, fast-tracking nuclear reactors, and injecting $2.7 billion to revive domestic uranium production. Foremost is one of the few Nasdaq companies with up-and-coming uranium projects right here in North America and they are drilling right now to feed America’s nuclear comeback. This isn’t just energy….it’s about ending dependence on China and Russia.

These sweeping measures represent the most significant demand catalyst for uranium in half a century, structurally repositioning supply chains and accelerating timelines for companies like Foremost Clean Energy (FMST).

Global uranium demand is accelerating at breakneck speed, and Trump looks like he just lit the fuse6. Here’s why this isn’t just a rally—it’s a generational shift:

The market dynamics are simple. AI doesn't run on code; it runs on uranium. AI's energy needs are giving FMST the opportunity of a lifetime. Billions of dollars of deals of being announced every day that effect the macro uranium market including.

Foremost (partnered with Denison) is drilling the Athabasca Basin just as uranium's supply crisis hits - with prices projected to triple to $150+/lb by 2026. Perfect timing, perfect location!13

Foremost Clean Energy (NASDAQ: FMST) is not just another story stock. They’re backed by Denison Mines, fully funded with a $6.5M exploration budget, and surrounded by world-class deposits. This is a real project, in the right place, at a perfect time.

Their float is TIGHT, insiders and big funds own about 25% of the shares, meaning there aren't many available for regular folks. Low supply + high demand = VOLATILITY.

The limited number of shares available to the public is small, with a tight float of only ~9.55 million shares, coupled with increasing investor interest, appears to be leading to exaggerated price swings. This creates a "powder keg" effect, where positive news can trigger explosive moves. We're seeing elevated trading volumes exceeding ~400k+ shares per day in the last month, suggesting more eyes are on this stock.

Clean Energy (FMST), the perfect AI adjacency stock, is positioning itself to potentially be the solution for the future uranium supply needed to keep America’s tech boom running.

Foremost is going big in 2025. Their $6.5 million exploration program is the largest among Athabasca uranium juniors:

As the global energy landscape shifts, nuclear power is re-emerging as a critical component of clean energy infrastructure. At the heart of this resurgence sits Foremost

REFERENCES

2https://international.canada.ca/en/global-affairs/campaigns/canada-us-engagement/questions-answers

12https://www.ans.org/news/article-5667/bull-market-continues-for-uranium-stocks/

IMPORTANT NOTICE AND DISCLAIMER

Copyright 2025 © investorstockpicks.com is owned and operated by Connect 4 Marketing Ltd., a Quebec corporation. Contact: info@connect4marketing.io. This is the official website of coppersqueezereport.com and is not affiliated with Questrade, Interactive Broker, TD Ameritrade, Fidelity, Charles Schwab, or Ortbiton Financial.

Compensation Disclosure

This Advertorial is not investment advice. Information is believed reliable but not guaranteed for accuracy or completeness. It does not constitute a full analysis of any company’s financial condition, nor is it tailored to individual investment needs. Do not rely on this material to buy, sell, or hold securities. Always consult a licensed or registered professional before making investment decisions.

Foremost Clean Energy Ltd. has has engaged Connect 4 Marketing Ltd. ("Connect4") to provide targeted SEM advertising strategies focused on high-value financial keywords complemented by a sophisticated digital retargeting campaign aimed at engaging interested investors who have previously visited the company's informational landing page and 3rd party hosted pages. The term of the agreement with Connect4 is for a period of 3-month period beginning September 23, 2025, for $20,000 USD plus applicable taxes per month and will continue month-to-month there after until either party terminates by providing 7-days’ notice. Connect4 is registered in Brossard, Quebec at 5505 Boulevard Du Quartier, 702, J4Z 0R9. Connect 4 operates from 407 McGill St bureau 501, Montreal, Quebec, H2Y 2G3 and can be reached at Carlos@connect4marketing.ca or by phone @ 1 (514) 970-1316.

Publisher may also collect reader email addresses, which it may monetize.

As of the date of this Advertorial, Publisher holds no securities of Foremost Clean Energy Ltd. and does not intend to purchase any during the contract term. Marketing services may result in greater investor awareness, trading activity, and/or a temporary increase in share price.

Educational and Informational Purposes Only

This Advertorial is not investment advice. Information is believed reliable but not guaranteed for accuracy or completeness. It does not constitute a full analysis of any company’s financial condition, nor is it tailored to individual investment needs. Do not rely on this material to buy, sell, or hold securities. Always consult a licensed or registered professional before making investment decisions.

Substantial Risk

Investing in securities involves significant risk, including the possible loss of your entire investment. Readers are solely responsible for their own investment research and decisions. Use this Advertorial only as a starting point for further independent research.

Not an Investment Advisor

Publisher and its owners, employees, and contractors are not registered as securities broker-dealers or investment advisors with the U.S. SEC, any state authority, or any self-regulatory organization.

Forward-Looking Statements

This Advertorial may contain "forward-looking statements" and "forward-looking information" as defined under applicable securities laws, based on management’s best estimates, assumptions, and current expectations. These statements include, but are not limited to, those related to future exploration and development plans for the Company’s properties and the acquisition of additional exploration projects. All statements included in the Company’s Presentation, other than historical facts, are considered forward-looking statements. Such statements encompass, without limitation, the Corporation's opinions and beliefs, financial position, business strategy, budgets, reserve estimates, development opportunities, and management's plans for future operations. Terms such as “estimate,” “project,” “anticipate,” “expect,” “intend,” “believe,” “hope,” “may,” and similar expressions, as well as “will,” “shall,” and other indications of future tense, are intended to identify forward-looking statements.

These forward-looking statements should not be construed as guarantees of future performance or results. They involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied, including, but not limited to: risks related to obtaining necessary regulatory and third-party approvals for proposed operations, risks associated with the Company’s exploration properties, international operations, general economic conditions, actual results of current exploration activities, unexpected reclamation expenses, changes in project parameters, fluctuations in commodity prices (including lithium and gold), foreign currency exchange rates, increases in mining consumables costs, potential resource variations, equipment failures, accidents, labor disputes, title disputes, insurance limitations, and other mining industry risks. Additionally, delays in exploration activities and changes in governmental regulations, tax rules, and political and economic conditions may also impact results.

While the Company (Foremost Clean Energy Ltd.) has endeavored to identify significant factors that could cause actual results to differ materially from those in forward-looking statements, other factors may also affect results. There can be no assurance that such statements will prove accurate, as actual results and future events may differ materially from those anticipated. The forward-looking statements and information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or publicly announce the results of any revisions to forward-looking statements or information contained herein, except as required by law. Consequently, readers should not place undue reliance on these forward-looking statements.

Such forward-looking statements reflect the Corporation’s views as of the date of this Presentation and involve known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of the Corporation, or industry results, to differ materially from those expressed or implied. These factors include, among others, the Risk Factors outlined in the Corporation’s Quarterly Management Discussion and Analysis. Given these uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements, which are valid only as of the date made. For further information regarding the risks affecting the Company and its business, please refer to the Company’s most recent filings under its profile at www.sedar.com.

ALWAYS DO YOUR OWN RESEARCH

Consult a licensed investment advisor before making any investment decision. This communication should not be used as the sole basis for investment.

Trademarks

All trademarks referenced are the property of their respective holders, and no endorsement is implied.

Liability Disclaimer

Publisher makes no guarantee or warranty regarding the information provided. To the maximum extent permitted by law, Publisher disclaims liability for any losses arising from reliance on this communication.